Commercial Real Estate: The Road to Decarbonization

Reducing environmental impact has become a top priority for companies worldwide. In the context of commercial real estate, this urgency translates into the need to decarbonize portfolios swiftly and comprehensively. The effects of climate change are increasingly evident, prompting businesses to take an active role in minimizing their carbon footprint. Consumers favor environmentally conscious brands, and employees seek out sustainably aware employers. Governments and regulators are pushing for carbon reduction, while investors demand evidence of companies prioritizing decarbonization.

Decarbonization requires clear strategies, ambitious targets, and well-defined roadmaps. But the clock is ticking—over the next decade, companies must prepare for significant changes. According to CBRE, a global leader in commercial real estate services and investments, more than 450 firms have committed $130 trillion to achieving net zero, yet only 15% of global assets currently align with the Paris Agreement’s 1.5°C target1.

As part of our annual Client Advisory Board, we held a dynamic panel discussion with various industry leaders on CRE’s road to decarbonization. From sustainable design evolution to business strategy, investment management, portfolio optimization, electrification, and emerging trends, we explore how the industry can navigate this transformative journey toward a greener future.

Moderator: Nancy Kohout, Engineering Leader, SmithGroup

Panelists

- Katie Bergfeld, Chief, Building Performance & Enforcement Branch, DC Department of Energy & Environment

- Karen Butler, Senior Project Manager, U.S. Environmental Protection Agency

- Giuliana Kunkel, Associate Director, Environmental, Social & Governance, Real Estate & Agricultural Finance, MetLife Investment Management

- Stet Sanborn, Engineering Leader, SmithGroup

Sustainable Design Evolution

Nancy Kohout kicked off the panel discussion by asking veteran sustainable design professional and Senior Project Manager from the U.S. Environmental Protection Agency, Karen Butler, about her observations regarding the evolution of sustainability. Karen attended the first LEED meeting where a group of engineers, architects, and policy makers grappled with creating a system to identify what exactly sustainability was. “Over the years, it’s grown, and we’ve added a lot more pieces to the equation.”

Karen recalled when EPA first launched Green Lights in 1991 which focused on reducing energy consumption through lighting. “Then we moved from lighting to products and eventually to commercial buildings. Energy was a means to an end. People don’t understand the atmosphere, but they understand energy. They understand the light bulb design, they understand the washing machine’s energy source, and the bill they receive every month. With that, we tried to focus on energy for people to understand how climate is being impacted.” Now the focus is on helping building owners, architects and engineers design buildings that reduce greenhouse gas emissions going into the future.”

Business Strategy & Investment Management

With the understanding that construction and the operations of buildings is responsible for 39% of the world’s global emissions, the urgency to reduce carbon emissions in the commercial real estate sector has intensified. Investors, occupiers, and businesses are recognizing the need to develop clear strategies for decarbonization. Giuliana Kunkel, Associate Director, Environmental, Social & Governance, Real Estate & Agricultural Finance at MetLife Investment Management, shared Metlife’s goal of being net zero by 2050, dubbing the program their “Met zero approach,” which encompasses the following strategies:

Energy Efficiency: Prioritizing investments in energy-efficient measures within buildings. This includes optimizing systems, improving insulation, and minimizing energy waste.

Onsite Renewables: Deploying onsite solar installations to generate clean energy directly at the properties. This approach contributes to reducing reliance on fossil fuels.

Green Riders and Contracts: Adding green riders to electricity contracts and exploring natural contracts in deregulated states. These options allow for more sustainable energy sourcing.

Renewable Energy Certificates (RECs): Some investment funds focus on purchasing RECs, which represent renewable energy generation. These certificates offset emissions associated with energy consumption.

Offsets: Certain funds aim for carbon neutrality by purchasing reduction offsets. These offsets compensate for emissions that cannot be eliminated directly.

While the commitment to decarbonization is clear, the real estate sector faces challenges. Balancing environmental goals with financial viability is essential. Every project undergoes rigorous ROI analysis, ensuring alignment with fiduciary responsibilities and JV partners. Investor interest in sustainability metrics, such as the Global Real Estate Sustainability Benchmark (GRESB) score, continues to grow.

Electrification & Grid Quality

During the panel discussion, several experts emphasized the critical role of electrification in reducing carbon emissions within the commercial real estate sector. Stet Sanborn, Engineering Leader at SmithGroup, shared intriguing findings from analytics conducted on building models. Even in regions with “dirty grids,” switching to highly efficient all-electric heat pump systems resulted in significant carbon savings. Coal country, for instance, saw 20% to 30% reductions. Meanwhile, in California, where the grid is cleaner, savings reached up to 60%.

The impact of electrification is further amplified when combined with onsite solar or renewables. Even in districts with less favorable grids, adding onsite renewables can lead to substantial emissions reductions. Nancy Kohout highlighted the efficiency of heat pumps. These systems allow for moving three units of heat with just one unit of energy, compared to burning one unit of fossil fuel to get less than one unit of heat. Opting for heat pumps contributes to operating cost savings and carbon reduction.

Katie Bergfeld, Chief, Building Performance & Enforcement Branch at the DC Department of Energy & Environment, clarified that electrification need not hinder efficiency. EPA studies demonstrate that the operational savings from electrified systems often outweigh upfront costs, driving down both carbon emissions and utility expenses. Karen Butler emphasized that energy use intensity varies based on property type. Warehouses, for instance, have lower intensity due to their primary function of moving goods.

Electrification, when strategically implemented, aligns environmental goals with financial viability, making it a crucial aspect of decarbonization in commercial real estate.

Trends & Innovations

Technological advances are occurring at an unprecedented rate. Nancy Kohout commented, “it feels like a full-time job keeping up with the new tools and technologies related to decarbonization.” Let’s dive into some key innovations:

Grid Interaction and Aggregation Programs: Stet Sanborn emphasized the dynamic nature of grid mixes, especially in certain states. Aggregators now offer financial incentives to building owners who participate in aggregation programs. By implementing energy-saving measures across portfolios (such as thermostat resets), owners can earn compensation. This approach is more cost-effective than building new peaker plants and contributes to grid resilience.

Resilience and Grid-Scale Batteries: The discussion highlighted the role of grid-scale batteries in maintaining grid stability during extreme events. Nancy Kohout pointed out that large-scale batteries, combined with aggregation programs, helped California avoid rolling brownouts during a recent heatwave. Building resilience through such technologies ensures uninterrupted operations.

Scope Emissions and Supply Chain Considerations: Understanding emissions scopes is crucial. Scope 1 (building-specific emissions), Scope 2 (utility-related emissions), and Scope 3 (supply chain emissions) all play a role. As Karen Butler noted, codes serve as a baseline, but additional metrics (like BEPS) can guide sustainable design decisions from the outset.

Embodied Carbon and Decision-Making: The focus is shifting beyond operational efficiency. Jules Kunkel highlighted embodied carbon—considering the environmental impact of construction materials. Tracking embodied carbon throughout a building’s lifecycle is essential. Innovations like low-carbon concrete and mass timber are gaining attention.

Data-Driven Efficiency: Data analytics drive efficiency improvements. Karen Butler emphasized the importance of making informed decisions based on energy use intensity, property type, and regional context. As technology evolves, tracking embodied carbon and optimizing energy use will become even more precise.

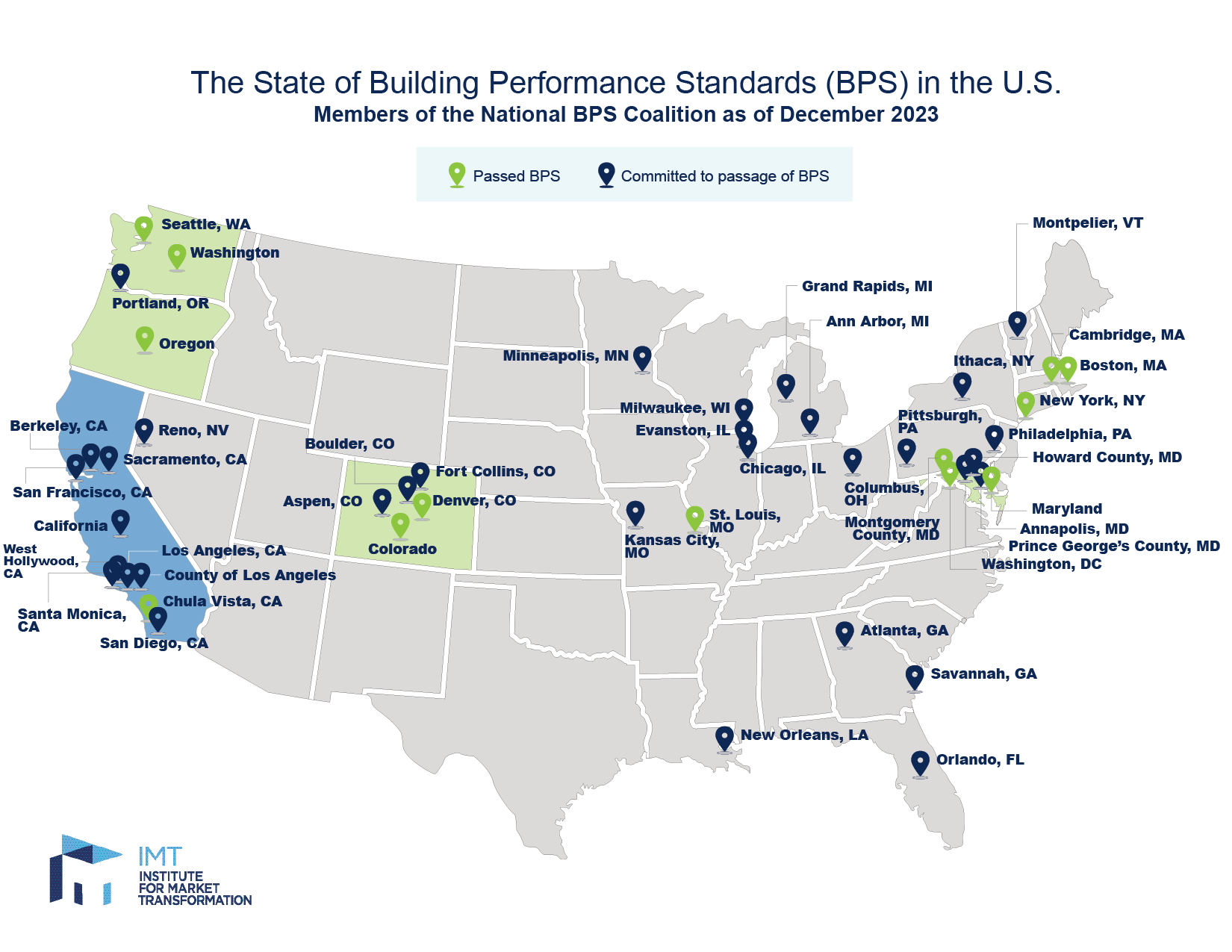

In summary, the convergence of technology, data, and sustainability principles is reshaping the commercial real estate landscape. The focus on real-world performance, rather than theoretical models, highlights the need to leverage actual performance data, benchmarking tools, and national models to drive energy efficiency and decarbonization efforts in buildings. Access to data, facilitated by organizations like the National Coalition for Building Performance Standards, has become increasingly critical. Notably, 12 jurisdictions— including trailblazing cities such as New York and Washington, DC, as well as four states (Washington, Oregon, Colorado, and Maryland)—have already passed Building Performance Standards by the end of 2023. This legislation impacts a significant portion of the U.S. building stock, specifically those over 25,000 square feet.

This moment presents a unique opportunity for collaboration among federal, local, and private sector entities. By embracing these trends, professionals can effectively navigate the path toward decarbonization and contribute to a greener, better future.

SOURCES

1 Anonymous (n.d.). Decarbonizing Commercial Real Estate. CBRE. https://www.cbre.com/insights/reports/decarbonizing-commercial-real-estate